ERISA-Aware Custody

From prohibited transaction risk to plan design, AET’s platform supports compliance with IRS and ERISA regulations. We’re built to handle Solo 401(k)s, checkbook LLCs, trust-held IRAs, and more.

Administer or Advise

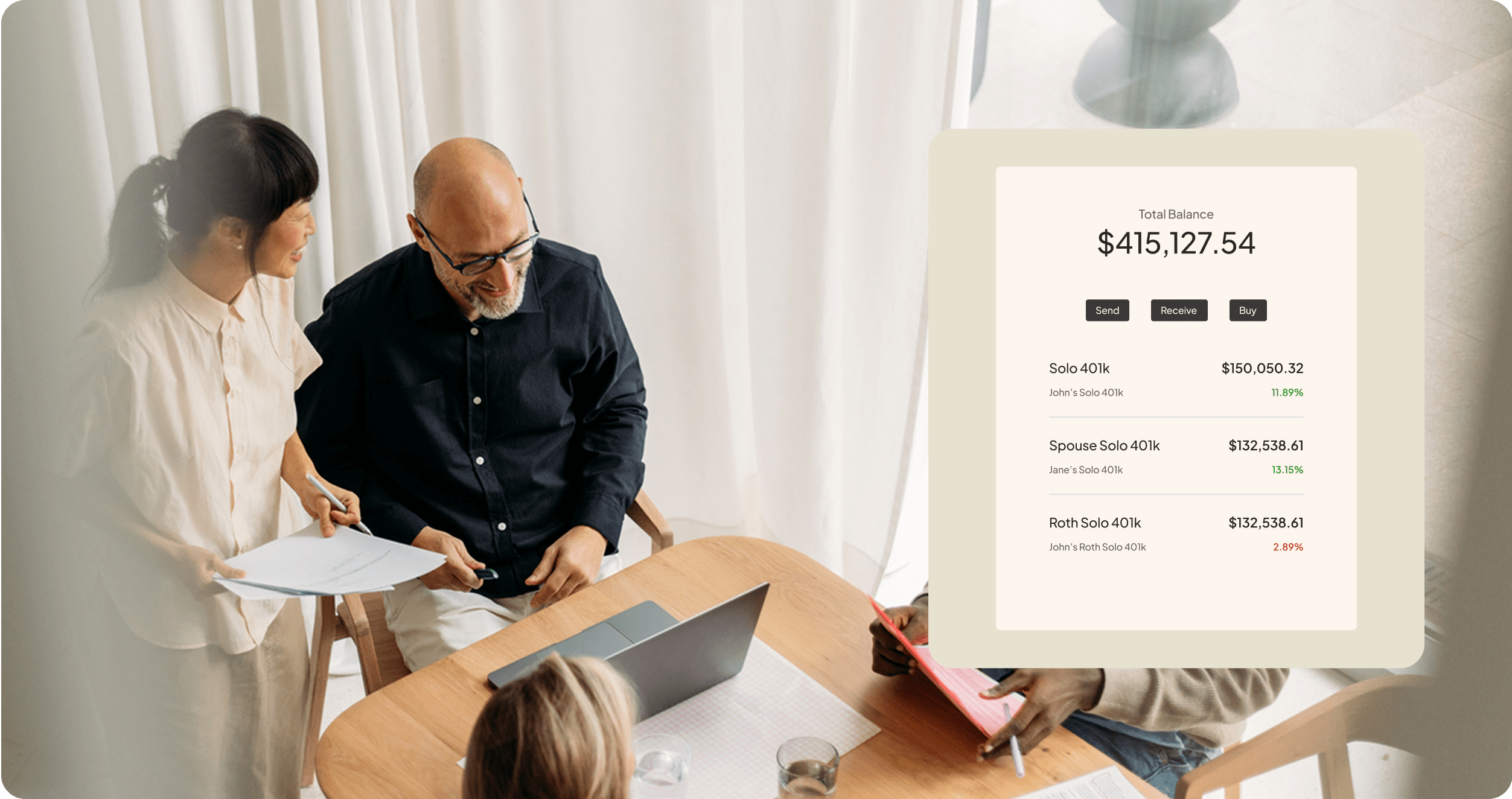

Prefer to maintain hands-on control? You can oversee and administer your clients’ accounts directly with no need to pass the work to a third party or chase down documentation.

Comprehensive Retirement Custody

Through our integrated business portal, CPAs can easily access account data, view investment holdings, and streamline year-end reporting, all while ensuring assets remain compliant.

Entity & Asset Structure Expertise

From LLC operating agreements to estate-planning considerations, we’re familiar with the intricacies of private wealth structuring inside retirement plans.

Easy handoffs when needed

Need to transition control over to a client or their advisor? Our portal makes the handoff simple and pain-free

Audit-Ready Recordkeeping

Eliminate the scramble at tax time. AET offers clear audit trails, complete contribution and distribution history, and valuation support for private assets.

Simplified UBIT/UBTI Oversight

We provide visibility into when unrelated business income may apply, helping you prepare clients proactively and avoid downstream tax issues.

Transparent oversight

Maintain visibility into every account action. Detailed audit trails, account history, and built-in reporting tools.