Modern DAF Custody, Tailored to Your Needs

AET’s platform and APIs allow DAF sponsors, wealth managers, and charitable organizations to manage charitable assets in a secure, scalable, and fully compliant environment.

What We Support:

All Major Account Structures

All Major Account Structures

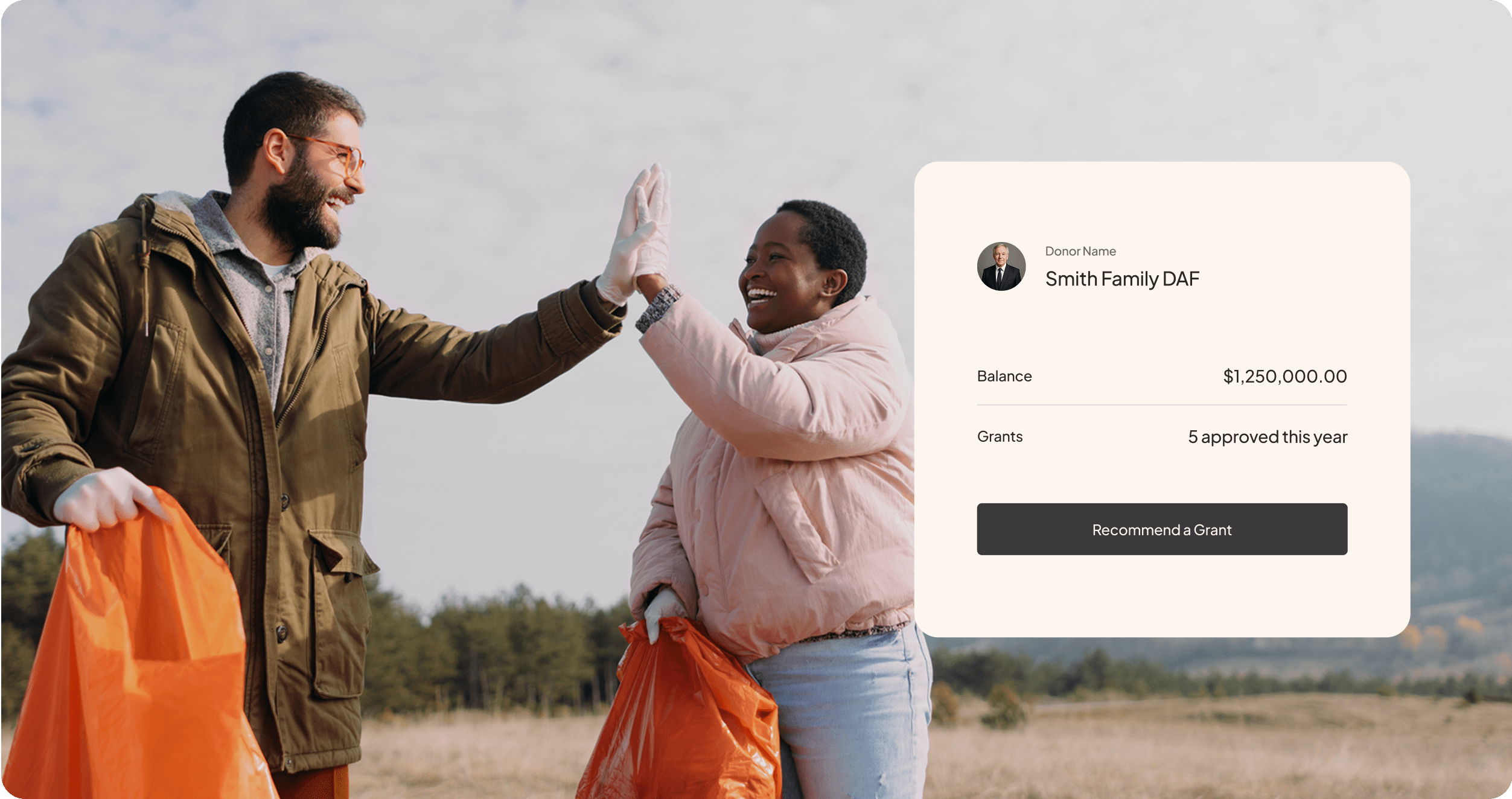

Support for individual, family, corporate, and pooled DAF accounts

Private Market Investments

Private Market Investments

Custody for alternatives such as real estate, funds, venture capital, and credit

Automated Contribution & Grant Tracking

Automated Contribution & Grant Tracking

Donor and grant activity tracked with full audit trail and permissions-based access

Integrated Tax & Reporting Tools

Integrated Tax & Reporting Tools

1099 generation, contribution statements, and real-time grant history

Flexible Disbursement Workflows

Flexible Disbursement Workflows

Multi-party authorization, rule-based approval flows, and treasury support