Support for Trust- Owned and Inherited Accounts

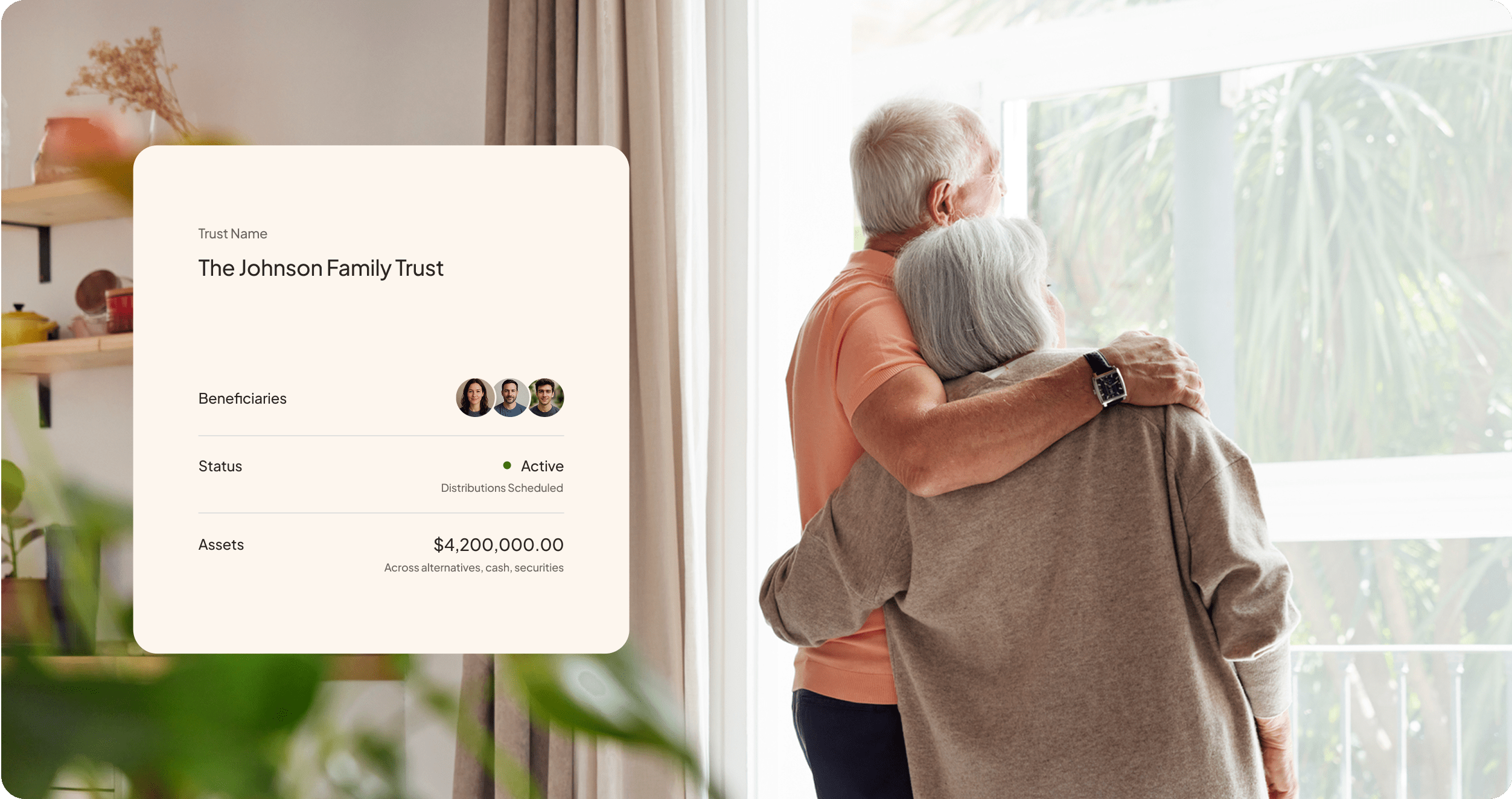

Whether you’re administering an inherited IRA, handling private assets held in trust, or navigating post-death distributions, AET provides:

Entity Support: Custody for trust-owned IRAs, estate accounts, and multi-party LLCs

Flexible Authority Controls: Assign view, control, or disbursement rights to attorneys, trustees, or beneficiaries

Private Asset Capabilities: Custody for real estate, private funds, notes, and direct investments

Tax & Compliance Handling: RMD tracking, 1099 issuance, and estate-related reporting